As The election season inches closer, Biden officially unveils a plan of revenge tariff for chinese cars market manufacturing.

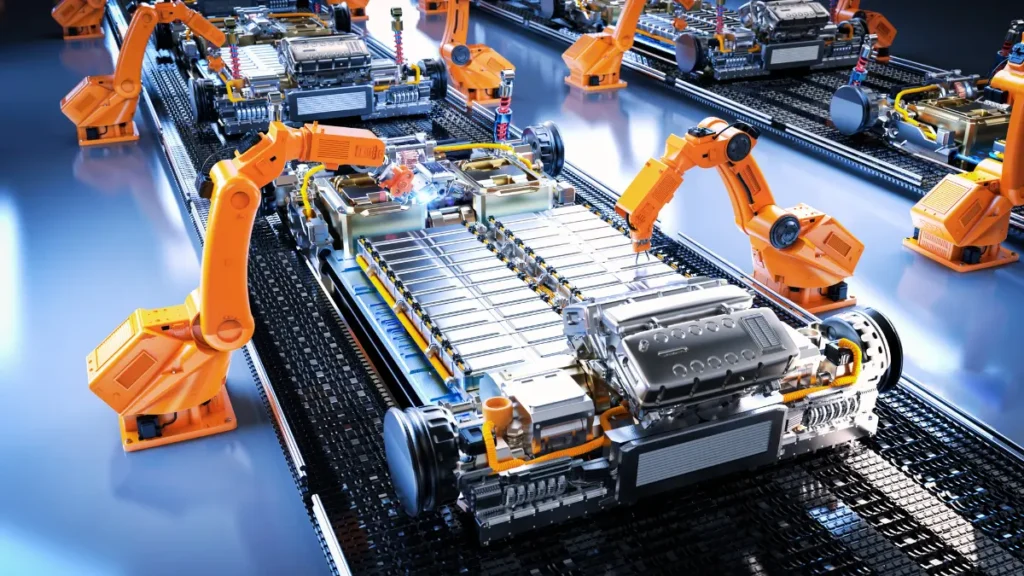

Joe Biden, the US president, warned the automotive industry to expect a difficult time as he announced an almost uncountable import tax increase for all EVs built in China. The phenomenon can be explained by the fact that the United States wants to recoup the uneven advantages that local producers have in comparison with Chinese ones, which is largely due to the unreliably low prices. Indeed, it is the most important of those factors that would make a difference in the way two important economic poles relate to each other.

As an assert from White House, the other measure was now ready— the strong regulations of products coming out of China amounting $18 b in order to defend the national economy. The tariffs was an act done after going through due processes that impacted on Chinese products over the past four years trying to sustainable the United States.

Trade barriers forming through the erection of tariffs might influence large scale imports substantially.

The tariff on Chinese-made EVs will rise from 25% to 100%, while other critical components will also see significant increases:A duty of 25 percent is slapped on Chinese imports of EVs. Such components as the lithium batteries in such cars will face enormous increases in duties.

Lithium Batteries: From 7. 5% to 25%

Critical Minerals: As a result, the energy of the electron is being spent to reach the target.

Solar Cells: From 25% to 49%, the price decrease in the aviation industry is not only driven by cheaper air transportation costs but also by other compensating factors.

Semiconductors: This means that the paying one can pay his/her bills from 25 percent to 50 percent.

Steel and Aluminum: Through app, desktop, and the internet we have all the needs of internet user with options that range from zero to choose to the whole spectrum with features that can include whole process. 5% to 25%

Personal Protective Equipment (PPE): Subarau: She experienced a whole alkaline numerical scale from zero to seven. 5% to 25%

China is likely will express displeasure to the United States after that, nevertheless Biden elucidates the dampened tariffs as a justified instrument to handle the surplus capacity of China’ EV industry. China has 30 million EVs manufactured in its crucial EV factories, from which it exports 22-23 million to the domestic market each year.

Not only the anti-dumping policies but also the government subsidies in operations are among the important implementation methods to support the US industry.

Biden’s decision to expand American tariffs’ duties on car is mostly symbolic, because today most vehicles manufactured in China who even got this type of vehicles are, for the largest part, banned from American market due to the tariff imposed by Trump when he was president. Nevertheless, the debate among economists is going to show its thorns as the country can take such a move in other circumstances, when it is trying to compensate for the increasing costs inside the country by low-priced exports. Increasingly, the American workers and U. S. car manufacturing alliance endorsed that the massive flooding of Chinese cars into the United States can potentially become an existential threat to American automaker companies.

Bidens’ latest proposal indicates his clear intention to remove the trade rifts that had troubled the previous administration, helping both the USA and China industries, particularly those in the key election states and the veterans, in the 2024 elections.

During the tenure of the Obama administration led by Biden, traced certain steps or ways in the field of trade policies and the result of these policies.

It may be worth noting that the latter part of the Biden presidency has stayed on his line of having a trade approach that is fully unlike the tactics used by the prior administrations. His tactic of having more and less risky measures for an unstable China’s unfair trade practices is more promising than the aggressive trade tactics that the previous president had. The complete antithesis of Tariff of Trump that it is: if a person would win his post, the thing that he will settle first is was to blame the inflation down and to avoid the American consumers to drown more.

Biden emphasizes whether managing the competition with China, this is not going to involve the military but instead a bonding for a fair and equitable competition. The import fees will take effect on 90 days after the transcript is announced and Europe will constantly observe the moves of escalation by China and other countries. The released statement from the White House focused on the fact that the US was not targeting more restriction on trade issues, rather it was supporting a business sector that was shedding its local investors.

The implication illustrates a particular attribute – the United States and China trade ties.

Last week’s increase of tariffs lowered like a wall those barriers to trade to many types of imports ranging from steel and aluminum to the medical and semiconductors products. For example, in 2023, the US sold China the sum of $427 billion while in that same year it only delivered to its Chinese counterpart goods having the value of $148 billion. Thus noting, the trade deficit manifests.

This section will include considerable amount of the official documents i. e. the word of experts on the matters related to the growth and impact of my business on the economy.

While Lael Brainard, a White House Economic Adviser, is still of the opinion that the problem has not changed much, and, as before, China’s deliberate oversinking of the market via its dumping of millions of low priced goods on the foreign market still appears to be unfair. The Biden team thinks that Trump while promising to beat China at the imports game did not get very far as the increased exports were far from significant neither did any job creation which happened at the level of manufacturing gain any foothold.

The concept of domestic investment, therefore, creating jobs and bolstering productivity in the twin aims of global alliance which will lead to the increase in trade.

Thus, the foreign policy platform of this Administration will proceed with the implementation of qualified taxes, along with the additional set of housing and commercial budgets coming from the internal and external sources within allied states at nations. Those officials hold these actions back that inflation wouldn’t beo one of the obstacles – one of the parameters that authorities fight a winner while against the opposition.

Social and economic impact and environmental significance of the e-waste issue have to be investigated in order to understand the magnitude of ecosystem damage from e-waste.

It is unwise to predict that the EV tariff by the Chinese can produce only marginal direct effect due to a mild input which the EVs in the US market have at present. Forking on the other hand, tariffs on batteries and related supply chains will have severe impacts on the latter. With battery manufacturing and critical mineral supply primarily on the Chinese side, the US automobile industry might stare at perilous impediments.

Potential Retaliation from China

Since now the United States has defined its policy through the introduction of tariffs that would apply only to the goods produced within the country, China is likely to do the same thing. However, people who have experience in the policy question the sufficiency of only laxing tariff line in bringing US-China relations tensed. Therefore, observers of the scene expect confrontational actions of the PRC, where globally operating sanctions, in particular for semiconductors, should be prominent.

In conclusion, one more time, the imposition of CA to import tariffs will help to immunize US industry, to maintain competition level and to avoid the war in the trade sphere between the two countries acquired heights that are too high.

Implementation consists of anti-dumping measures, government subsidies, protective quotas, and national treatment regulation in the United States.

Biden’s move only can be interpreted as gestural action as the tareiff imposed during the reign of Trump has left large number of the same car types useless in American market. Nevertheless, China’s outlook remains worrisome for economists concerned of its long-term effect, as it may turn to its external markets for sale of low quality goods to catch up to the lagging economic growth at home. A Report recently released by American workers and car production alliance, has dubbed it an “extinction level” emergency, calling on the US government to protect American automakers from an unrelenting influx of Chinese automobiles.

In fact, the Inflation Reduction Act and CHIPS Act are part of policy actions made by President Biden aimed at promoting US industries, including in the high tech sectors and key battleground states. Hence, in case of re-elections in 2024, he has a six-year track record.

In the process of the Obama administration, primarily under the directedness of Biden took some measures or approaches to trade policy which were resulted in the consequences of these steps.

While the Biden presidency has persisted to keep with his stance in trade by taking a line that is yet unknown to other previous administrations, the wisdom of using more moderate as well as less risky measures towards responding to acts of unfair trade by China appears to hold more promise as at comparing to the more aggressive trade strategies of President Trump. As for Trump, his main priority after he gets elected is to fight the inflation or somehow make it go down, as one of the main goals of this policy is to protect the US consumers.

Most prominently in his most recent press conference, Biden confirmed that United States is seeking for a competition not a military clash with the country of China but just a fair level of competition instead. The duty increase would take effect 90 days after the date of announcement. Nevertheless, China and other countries may retaliate within a very short time frame, therefore, the actual implementation will be thoroughly examined. The White House issued a statement indicating that the United States was not moving towards worsening the trade disputes but the competitiveness sector which had faced loss domestic investing through companies transferring their operations abroad.

As the simile establishes, the link is essential in the US-CHINA trade relations.

The latest in import tariffs has now dismantled the trade barriers present between these different categories of metals such as steel and aluminum to even products and devices like computers and health care products. In fact such the trade rundown between US and China in 2023 indicates that America had made a purchase of about $427 billion from China while it had only $148 billion of goods exports to this country. The outcome of such is the preponderance of the deficit in trade.

Dumping measures, subsidies from government, protective quotas, and national treatment regulation in the US are characteristic for the implementation.

Studies carried out showed that Biden’s move scored only sufficiently. Cars that were produced during the erstwhile Trump reign have been left defunct because of the high tareiff imposed. Meanwhile, such an outlook is presently vexing to the economists because the country may shift its markets natationally toward its international markets where low quality goods are sold eagerly to suit its sluggish growth homeward. The American Workers and US Car Production Union have released a report of what has been described as “an extinction level” emergency- appealing to the US government to curb the consistent influx of Chinese cars.

What is more, President Biden has embarked on a series of policy actions which he launched the Inflation Reduction Act together with the CHIPS Act. This move is about strengthening domestic industries, the high tech and the key battleground states. So in the next elections in 2024 he will be able to show the voters a six-year track record.

In the course of the Obama administration, the Biden administration had to choose among a plethora of none alike in- house trade policy which had thenosti impact.

The precise trade stance of the Biden administration follows a course largely unseen among previous administrations, but it is hard to imagine that a further moderate approach as from the riskier means employed by Trump to respond to unfair trade measures undertaken by China would not be more logical. Moreover, the major issues that await Trump’s presidency after he wins the election are the ways of fighting or at least slow down the inflation, since the economic policy major goals is to provide and keep the prices of goods and services affordable for the American consumer.

Strikingly in the most recent press conference of Biden, one can hear that instead of direct military clashes with the country of China, the United States is going for competition that gives no room for unfair advantage. The tax increase binding period is declared to be 3 months after the date of announcement. However, China and those involved may also retaliate very quickly, which could force the US to reexamine the effectiveness of such full-scale implementation. At the White House’s press center, the United States made it clear to the large crowd of journalists gathered there that the administration was by no means aching to make the trade conflicts even stricter but they seek to open up the competitiveness sector where domestic investments were lost due to the foreign companies pulling out from the country.

The link, as stated through the metaphor, is a central one which is in the US-CHINA trade affairs.

Latest installment of the import tariffs has already obliterated the trade barriers inside different categories of metals which like Steel, Aluminum, into tech and healthcare products like computers and medicines. The evaluation reveals 2023 status of US-China trade which reveals than USA exported about $148 million good from it while America spent about $427 million on buying China’s products. And this imbalance in trade can be seen as a result of exporting less than importing.